BENGALURU: Has the radio industry put in its best performance as yet? Preliminary conclusions based on the results filed by a few of the listed/segments of listed companies seem to indicate so, as do extrapolations of TRAI (Telecom Regulatory Authority of India) data that is as yet available until Q3-2015.

Note (1): (a)100,00,000 = 100 lakh = 10 million = 1 crore

(b) The author has taken the liberty to introduce two new measures – average revenue per radio station and average operating profit per station. These are rough yardsticks and may not necessarily be indicative of a station or a networks performance, because factors such as geography and market conditions within the area of operations are among many other factors will also determine performance

Let us look at Data from TRAI first – CAGR since FY-2012 is likely to be between 11 and 12 per cent

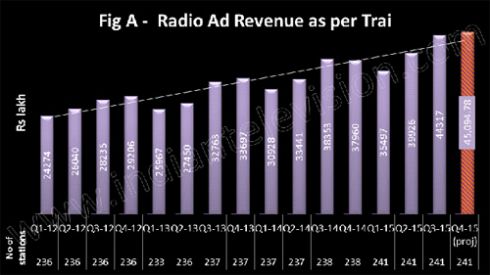

As per data from TRAI, radio advertisement revenue (ad revenue) has been increasing every quarter. Please refer to Fig A below which shows ad revenue for a 15 month period starting Q1-2012 (Quarter ended June 30, 2012) until Q3-2015 (quarter ended December 31, 2014). Ad revenue of Rs 450.95 crore for Q4-2015 has been calculated using the average percentage increase between Q3 and Q4 over 3 years (FY-2012, FY-2013 and FY-2014) – this works out to 1.76 per cent.

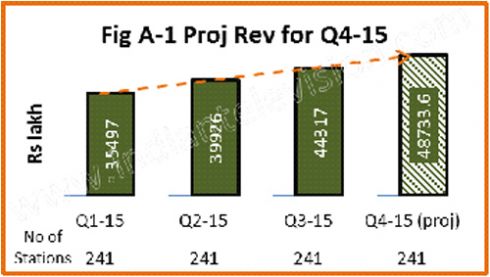

Ad revenue of Rs 487.336 crore for Q4-2015 (quarter ended March 31, 2015) is the projected revenue by the linear trend line in Fig A-1, which is based on the revenue of the first three quarters of FY-2015. This shows a growth of 19.75 per cent over FY-2014. This figure is quite close to the average (simple) revenue growth of 19.93 per cent by the six sample companies/entities, whose figures have been considered later in this report. (TRAI has not yet released data for Q4-2015 at the time of writing of this report. It must also be pointed out that TRAI has been releasing ad revenue data for lesser than the licensed number of radio stations, as indicated in the second line of the x- axis in Fig A below).

The trend line in Fig A indicates that ad revenue is increasing linearly. The figure also indicates that the radio industry has its lowest quarter in terms of ad revenue in Q1, progressively increasing in Q2 and Q3, with the highest ad revenue in Q4 in FY-2012 and FY-2013. There could be various reasons for this, and one that comes to mind is that Q4 is the fag end of the financial year and advertisers use this very local medium to push through sales and attain year end targets for better margins. It could also mean that major advertisers have already consumed a major portion of their ad budgets and are using the low cost alternative for grabbing consumer attention. However, in FY-2014, Q4-2014 ad revenue was lower than Q3-2014 by 1.02 per cent. Assuming the same trend is followed this year too, the projected ad revenue for Q4-2015 works out to about Rs 438.63 crore.

Based on the lower projected figure of Rs 438.63 crore, projected ad revenue for FY-2015 works out to Rs 1636.03 crore, and hence 16.29 per cent more than the Rs 1406.82 crore in FY-2014. Ad revenue in FY-2014 had grown 17.36 per cent from Rs 1198.77 crore in FY-2013. Since 2012, the industry’s ad revenue has shown a CAGR of 11 per cent, if one was to consider the lower projected ad revenue of Rs 438.63 for Q4-2015.

If we consider Q4-2015 ad revenue as Rs 450.95 crore, indicated in Fig A above, revenue for FY-2015 is Rs 1648.35 crore and CAGR works out to 11.21 per cent between FY-2012 and projected FY-2015 ad revenue.

If we consider the projected ad revenue for Q4-2015 as Rs 487.34 crore, then projected revenue for FY-2015 is Rs 1684.74 crore and CAGR between FY-2013 and FY-2015 (projected), works out to 11.82 per cent.

As mentioned above, based on TRAI, quarterly ad revenue data, total ad revenue works out to Rs 1406.82 crore for FY-2014, and the average ad revenue per station as Rs 5.92 crore for 237.5 stations. Please note that TRAI data for Q1-2014 and Q2-2014 was for 237 stations and for Q3-2014 and Q4-2015 for 238 stations, and hence a not very accurate median of 237.5 stations has been used to calculate the average ad revenue per station for FY-2014 above.

Based on the projected ad revenues for FY-2015 of 1636.03 crore, Rs 1648.35 crore, 1684.74 crore for 241 stations, the projected average ad revenue per station works out to Rs 6.79 crore, Rs 6.84 crore and Rs 6.99 crore respectively.

Let us look at how a few radio groups performed.

Note (2): (a) This report considers PAT posted by 2 radio companies (ENIL – Radio Mirchi, 32 radio stations; Jagran Prakashan – Radio City – 20 radio stations) and their operating results, along with operating results of DB Corp (My FM, 17 stations), B. A. G Films (Radio Dhamaal, 10 stations) and HT Media (Fever FM, 4 stations).

(b) EBIDTA numbers for ENIL (Mirchi) have been calculated by adding the depreciation to the total income from operations and subtracting the total expense from the result, assuming that ENIL reports interest in finance charges separately.

The numbers in the charts below cover just 89 FM Broadcasting stations of six sample companies/entities of the total of 241 or 36.93 per cent.

It is interesting to note that Radio Mirchi, with just 32 stations, (13.5 per cent of total number of stations of 237 in FY-2014 as per TRAI) contributed revenue of Rs 384.49 crore to a total ad revenue of Rs 1406.82 crore in FY-2015, or 24.77 per cent of total revenues of the industry.

Another great performer, Music Broadcast Private Limited (MBPL, now a part of the Jagran Prakashan group), Radio City with 20 stations (or 8.44 per cent of the total number of stations in FY-2014 of 237 as per TRAI) reported revenue of Rs 160.53 crore or 11.41 per cent of the ad revenue for FY-2014 as per TRAI data.

Of course, some of these companies/segments also have revenue streams other than radio, for example, Radio Mirchi conducts the Mirchi Music Awards every year and must also be reporting sponsorship revenue, but considering that many, and especially Radio Mirchi, MY FM, Radio City and Fever FM are parts of some of the biggest professionally-run media houses in the country, these entities will be able to leverage a reasonable amount of money from other streams. A few of the entities also have internet radio stations that have turned quite popular, more so among the Indian diaspora.

Y-o-y, Q2-2015 was the best quarter in terms of revenue for five (except Radio City, whose numbers for Q1-2015 and Q2-2015 are not available at the time of writing of this report) of the six entities. Combined Q2-2015 revenue for the five entities was Rs 157.12 crore, 20.05 per cent more than the Rs 130.88 crore in Q2-2014. If one were to neglect the loss reported by Oye FM and Radio Dhamaal during the quarter, then the operating profit/PAT for My FM, Radio Mirchi (PAT) and Fever increased by 80.56 per cent as compared to the previous year.

Income of the six entities

Combined Operating Income of the six sample companies in this report grew 17.34 per cent in FY-2015 to Rs 886.05 crore from Rs 738.05 crore (52.46 per cent of the total ad revenue as per TRAI for FY-2014). Please refer to Fig B below. As mentioned above, the simple average growth in revenue for the six companies was 19.93 per cent.

The highest growth was by BAG Films Radio Dhamaal with a revenue growth of 47.09 per cent in FY-2015 to Rs 7.48 crore (0.86 per cent of Operating Income of the 6 sample entities in this report in FY-2015) from Rs 5.09 crore (0.69 per cent of Operating Income of the 6 sample entities in this report in FY-2014). Oye FM grew the least – its operating income increased 0.64 per cent to Rs 15.48 crore (1.79 per cent of Operating Income of the 6 sample entities in this report in FY-2015) from Rs 15.38 crore (2.08 per cent of Operating Income of the 6 sample entities in this report in FY-2014). My FM, Radio Mirchi and Radio City showed double digit growth in operating income in FY-2015 of 20.68 per cent, 14.04 per cent and 30.42 per cent, respectively, while Fever FM’s operating revenue grew 6.72 per cent in FY-2015 as compared to FY-2014.

Operating Results -PAT and Margins of the six entities

Combined Operating result - of the six entities – operating profit grew 33.07 per cent to Rs 260.43 crore in FY-2015 from Rs 195.71 crore in the previous year. Four of the six sample entities reported growth in operating profit in FY-2015 as compared to FY-2014, while the other two reported lower operating loss in the current year (FY-2015) as compared to the previous year.

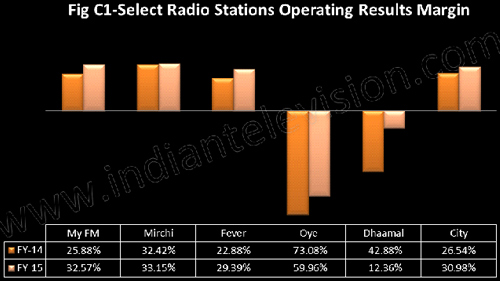

Pease refer to Fig C and Fig C1 below. Radio Mirchi’s operating profit in FY-2015 of Rs 145.34 crore (55.81 per cent of combined operating profit of 6 entities in FY-2015) was 16.59 per cent more than the Rs 124.66 crore (63.7 per cent of combined operating profit of 6 entities in F-2014). Its operating margin in FY-2015 improved marginally to 33.15 per cent from 32.42 per cent in the previous year. Radio Mirchi’s operating margin was the highest for both years among the six entities considered in this report.

Radio City’s operating profit in FY-2015 increased 52.3 per cent to Rs 64.86 crore (24.9 per cent of combined operating profit of 6 entities in F-2015) from Rs 42.60 crore (21.77 per cent of combined operating profit of 6 entities in FY-2014 FY-2014). Its operating margin improved to 30.98 per cent in FY-2015 as compared to the 26.54 per cent in the previous year.

My FM reported a 51.89 per cent growth in operating profit to Rs 31.23 crore (11.99 per cent of operating profit-reported by the 6 sample entities in this report in FY-2015) from Rs 20.56 crore (10.51 per cent of operating profit-PAT reported by the 6 sample entities in this report in FY-2014). Its operating margin increased to 32.57 per cent from 25.88 per cent in FY-2014.

Fever FM’s operating profit grew 37.07 per cent to Rs 29.21 crore (11.22 per cent of operating profit-PAT reported by the 6 sample entities in this report in FY-2015) from Rs 21.31 crore (10.89 per cent of operating profit-PAT reported by the 6 sample entities in this report in FY-2014). Its margin increased to 29.39 per cent from 22.88 per cent.

It may be noted that ENIL (Radio Mirchi) reported profit after tax of Rs 105.97 crore (24.2 per cent of Total Income from Operations or TIO) in FY-2015, which was 26.99 per cent more than the Rs 83.45 crore (23.32 per cent of TIO) in the previous year. Further, Radio City also reported a doubling of PAT in FY-2015 to Rs 42.95 crore (20.51 per cent of TIO) from Rs 21.45 crore (13.36 per cent of TIO) in FY-2014.

Results per station

As mentioned above, these measures are rough yardsticks and may not necessarily portray a true picture of a station or a networks performance.

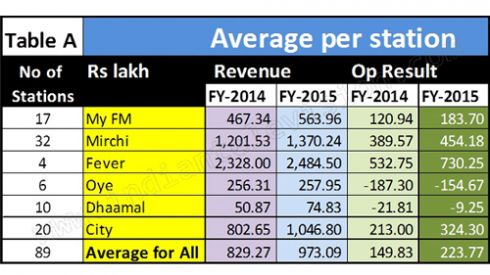

The average revenue per station for all the 89 radio stations of the six entities in this report grew to Rs 9.73 crore in FY-2015 from Rs 8.29 crore in the previous year. The average operating result per station based on EBIDTA for all the companies increased to Rs 2.93 crore in FY-2015 from Rs 2.20 crore in the previous year.

Please refer to Table A below for details of the 6 entities. Fever FM reported the highest revenue per station in both FY-2015 and FY-2014 at Rs 24.84 crore and Rs 23.28 crore, respectively. The next highest revenue per station was Radio Mirchi, with 32 stations, and revenue of Rs 13.70 crore and Rs 12.02 crore in FY-2015 and FY-2014, respectively.

Radio City’s average revenue per station improved to Rs 10.47 crore in FY-2015 from Rs 8.03 crore in the previous year, when it was lower than the average revenue per station of the 6 entities in this report.

Fever FM also reported the highest operating profit per station at Rs 7.30 crore in FY-2015 as compared to the Rs 5.33 crore per station in FY-2014. The next highest on this parameter was Radio Mirchi. On considering its standalone EBIDTA for FY-2015 at Rs 145.34 crore, based on the numbers reported by the company on the bourses, Radio Mirchi’s average operating profit per radio station works out to Rs 4.54 crore. For FY-2014, Radio Mirchi EBIDTA was Rs 124.66 crore and its average operating profit per station was Rs 3.90 crore. Radio City’s average operating profit per station works out to Rs 3.24 crore in FY-2015 as compared to the Rs 2.13 crore in FY-2014.

Conclusions

As per the FICCI-KPMG Media and Entertainment Report 2015 (FICCI M&E 2015 Report), the radio industry saw a phenomenal 17.6 per cent growth in 2014. The report pegs the radio industry size for 2014 in India at Rs 1720 crore (Rs 7.24 crore average revenue per station on a base of 237.5 stations). With the implementation of Phase III, FM radio will reach 85 per cent of India’s territory, further adding the medium as an important part of advertisers’ plans because radio is likely to be a cheaper alternative due of its reach. More stations are also likely to result into stronger regional networks.

Although, Phase III auctions have been curtailed to just 135 stations in 69 cities and further delayed to the latter half of fiscal 2015, the industry feels that Phase III could herald a new era for radio in India.

The FICCI M&E Report 2015 says that growth in 2014 could be attributed to several reasons that include new upcoming sectors like e-commerce and industries such as real estate, retail and lifestyle products. The report says that many of the players reached 100 per cent inventory utilisation and hence many hiked ad rates. There seems to a welcome change for the industry which saw advertisers shift focus from nationwide brand building to more local focused promotional targeting, feeding on the strength of radio as a medium. Content innovation also contributed to the strong performance by many players. The General Elections of 2014 also saw election spends finding its way to the radio industry with spends of around 12 to 15 per cent of ad budgets as opposed to the normal 1 to 3 per cent. The Prime Minister’s address to the nation on All India Radio through his show ‘Mann ki Baat’ has gained a lot of attention for the medium.

Challenges continue to hound the industry with smaller and standalone stations feeling the pressure of rising cost structures, measurement and royalty fee issues and the rising threat of the digital media eating into the radio ad budget pie. The good news is that now advertisers see radio as an integral part of their media plans, not just an add-on expense head.

Yes, FY-2015 is the best year yet for the radio industry so far, but the future is far brighter for the industry and its ecosystem. Delays in Phase III could dim the brightness, though.